MONE$Q® PLATFORM AGREEMENT

This Platform Agreement is a binding agreement between you and MONESQ, a division of FINTEX8, Inc. (the “Company”), and governs your use of all of the Company’s Services as a current or prospective customer (“you”, “your”), including mobile applications, websites, software, and our other products and services (collectively, the “Services”). In this Platform Agreement, “you” or “your” includes any entity or individual that uses any of the Services and “Company” or “we” or “us” means MONESQ, a division of FINTEX8, Inc. and its affiliates, successors and assigns. References to “Platform Agreement” include the document that you’re reading and any terms, agreements, and policies referenced, including any additional terms specific to the Services you use. By using any of the Services, you agree to all the terms and conditions in the Platform Agreement, including our Privacy Policy. You also agree to any additional terms specific to Services you use (“Additional Terms”), such as those listed below, which become part of your agreement with us (collectively, the “Terms”). You should read all of our terms carefully.

- Payment Terms: These terms apply to all payments made through the MONESQ platform, using MONESQ payment partners.

- Plus Terms: These terms apply when you use the module that includes time and expense tracking and trust accounting functionality.

- Partner Terms: These terms of our payment partners apply when you open a Merchant Account in order to accept online payments in MONESQ.

- Mobile Terms of Service: These terms apply to all Services accessed via mobile devices.

- Professional Website Terms of Service: These terms apply when you use the Professional Website builder in the MONESQ platform.

To use the services you must submit a merchant application and open an account. The terms and conditions of this Platform Agreement are binding as of the date you submit a merchant application or begin using any of the Services. Until your merchant application is approved, your use of the Services available within MONESQ is limited to entering new contacts and creating your firm profile. If your merchant application is declined for any reason, you will not be able to use MONESQ, and your MONESQ account will be deactivated. By using any of the Services you consent to receive all Notices and communications electronically. We may amend the Terms at any time that we deem to be reasonable under the circumstances, by posting the revised version on our website or communicating it to you through the Services (each a “Revised Version”). The Revised Version will be effective as of the time it is posted, but will not apply retroactively. We may also give you additional Notice of any changes that we believe are material. Your continued use of the Services after the posting of a Revised Version will constitute your acceptance of the Revised Version. Any Dispute that arose before the changes will be governed by the Terms in place when the Dispute arose.

Definitions for other capitalized terms are included below in Section 4.

You may only use the Services if you agree to this Platform Agreement, so read it carefully. Please contact us if you don’t understand any of the terms of this Platform Agreement.

Section 3.6 of this Platform Agreement includes an agreement to resolve any Disputes through binding arbitration and a waiver of any consolidated or class actions, along with important disclaimers and limitations of liability.

1. Creating an Account

1.1 Eligibility

To use the Services, you must open a Merchant Account with Stripe Payments., our payment processing partner. Only Merchants located in the United States may apply for a Merchant Account and use the Services. If the Merchant is an entity, that means that the entity must be organized and registered in the United States (such as C-corps, S-corps, LLCs, or LLPs). These include professional corporations, professional LLCs, and professional partnerships. Merchants operating as sole proprietorships or private partnerships that are located in the United States may also apply for a Merchant Account and use the Services.

1.2 Requirements

Representations of Merchant

By submitting a Merchant application, the natural person submitting the application represents and warrants in an individual capacity and as an authorized representative of Merchant that:

- Merchant is a business entity that is organized, registered, and located in the United States or, if not registered, is a sole proprietorship or private partnership that is located in the United States

- In the Merchant application, Merchant has provided a valid tax identification number corresponding to the type of entity indicated in such application

- The natural person who applies for a Merchant Account on Merchant’s behalf is at least 21years of age and is authorized to provide information about Merchant, submit the application on behalf of Merchant, enter into binding agreements on behalf of Merchant, and manage the Merchant Account

- All information you provide to us is and will be current, accurate, and complete

- Merchant will use its Merchant Account exclusively for business purposes and not for any personal, family, or household use

- You have reviewed this Platform Agreement and the Terms.

Required information

You must provide certain Merchant Data to apply for and maintain a Merchant Account and any Services. Merchant Data may include registered business name, business address, ownership details, contact information including email and phone number, tax identification number, the nature of the business, financial information, details for your Linked Accounts, and other business information that we or our payment partner may require or request from time to time.

You must also provide certain Personal Data including the names, contact information, personal addresses, social security numbers, and dates of birth of Beneficial Owners, and Control Persons. You may also be required to provide certain documentary information used to verify Merchant data, including corporate registration certificate, proof of address, or personal identification.

You must connect at least one Linked Account to use our Payments services. If you have only one Linked Account, it must be your Operating Account. You authorize us and our payment partners to verify that the account details you provided for your Linked Account are correct and the Linked Account belongs to you by initiating a microdeposit to and corresponding debit from the Linked Account via ACH or by other similar means.

To help the government fight the funding of terrorism and money laundering activities, U.S. federal law requires that financial institutions obtain, verify, and record Merchant data and Personal Data identifying companies and their Beneficial Owners and Control Persons. You agree to provide the required information to open and maintain your Merchant Account and agree to keep such information current. This information may be shared with Program Partners and Third-Party Service Providers for these purposes. You may be required to verify information previously provided or provide additional information in the course of applying for or receiving certain Services.

You acknowledge that you have obtained or will obtain appropriate consent and authorization of any person whose Personal Data you provide before sharing such data with us.

Verification and validation of information

We and our Program Partners rely on the accuracy of the information you provide when opening and maintaining your Merchant Account. You acknowledge and agree that we may use and provide Merchant data and Personal Data to Program Partners and Third-Party Service Providers to validate the information you have provided and determine your eligibility for the Services, as described in the Privacy Policy.

We may deny your application, interrupt provision of the Services to you, or suspend or close your Merchant Account if the information you provided is incomplete, inaccurate, or out of date.

Consent to electronic signature and communications

You agree that submitting your application for a Merchant Account and indicating consent to this Platform Agreement constitutes your electronic signature. You also agree that your electronic consent has and will have the same legal effect as a physical signature. You consent to us providing Notices and account statements to you electronically, and understand that this consent has the same legal effect as would a physical signature.

Supplemental agreements

In certain circumstances, including where we deem a Merchant to present a high risk to us, or where we are required by a Program Partner, we and/or our Program Partners may require supplemental agreements with Merchant or parties affiliated with Merchant. The availability of specific Services to Merchant may be subject to these supplemental agreements. We may add or change the applicability of these requirements and the supplemental agreements at any time. Merchant or parties affiliated with Merchant (including affiliates or Control Persons) may be required to enter into such supplemental agreements in order to access or continue use of the Services.

Prohibited and Restricted Activities

You may not, nor may you permit any third party, directly or indirectly, to:

- export the Services, which may be subject to export restrictions imposed by US law, including US Export Administration Regulations (15 C.F.R. Chapter VII);

- engage in any activity that may be in violation of regulations administered by the United States Department of the Treasury’s Office of Foreign Asset Control (31 C.F.R. Parts 500-599). Prohibited activity includes but is not limited to the provision of Services to or for the benefit of a jurisdiction, entity, or individual blocked or prohibited by relevant sanctions authorities, including but not limited to activities in Iran, Cuba, North Korea, Syria, or the Crimean Region of the Ukraine. If found to be in apparent violation of these restrictions, your account could be terminated;

- access or monitor any material or information on any of our Services using any manual process or robot, spider, scraper, or other automated means;

- except to the extent that any restriction is expressly prohibited by law, violate the restrictions in any robot exclusion headers on any Service, work around, bypass, or circumvent any of the technical limitations of the Services, use any tool to enable features or functionalities that are otherwise disabled in the Services, or decompile, disassemble or otherwise reverse engineer the Services;

- perform or attempt to perform any actions that would interfere with the proper working of the Services, prevent access to or use of the Services by our other customers, or impose an unreasonable or disproportionately large load on our infrastructure;

- copy, reproduce, alter, modify, create derivative works, publicly display, republish, upload, post, transmit, resell or distribute in any way material, information or Services from us;

- use and benefit from the Services via a rental, lease, timesharing, service bureau or other arrangement;

- transfer any rights granted to you under this Platform Agreement;

- use the Services in a way that distracts or prevents you from obeying traffic or safety laws;

- use the Services for the sale of firearms, firearm parts, ammunition, weapons or other devices designed to cause physical harm;

- use the Services for any illegal activity or goods or in any way that exposes you, or our other users, partners, or us, to harm; or

- otherwise use the Services except as expressly allowed under this Platform Agreement.

If we reasonably suspect that your Account has been used for an unauthorized, illegal, or criminal purpose, you give us express authorization to share information about you, your Account, and any of your transactions with law enforcement.

1.3 Data and Privacy

We process Personal Data in accordance with the Privacy Policy. You acknowledge, understand, and agree that we will collect, process, and share Merchant data and Personal Data to provide the Services in accordance with this Platform Agreement and the Privacy Policy. You acknowledge that you have reviewed and consent to our Privacy Policy, which explains our practices with regard to any personal information you provide to us. If you or your business is located in California, please see Section 3.7.

2. Managing and Using Your Merchant Account

2.1 Authorized Users

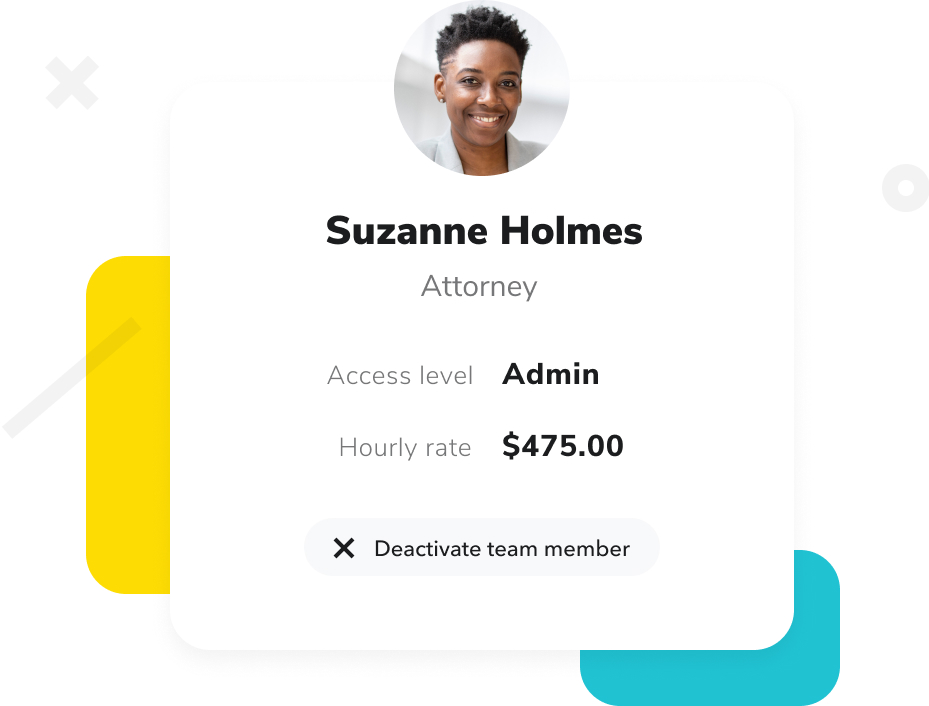

Administrators

You must specify at least one Administrator to manage your Merchant Account. Administrators must have, and Merchant represents that any individual designated as an Administrator has, the requisite organizational power and authority to conduct business and manage your Merchant Account. If an individual designated as an Administrator no longer has such requisite organizational power and authority, Merchant must notify us promptly and designate another Administrator for your Merchant Account.

Administrators may: add, remove, or manage additional Administrators and Users; view transactions; view and run reports and download statements; provide or update Merchant data; connect Linked Accounts, Third-Party Services, and other accounts to your Merchant Account; consent to any new or updated terms or conditions contained in this Platform Agreement or other agreements or policies incorporated in this Platform Agreement, consent to supplemental agreements, or consent to any Additional Terms; and take actions specified in the Program Terms and perform other tasks on Merchant’s behalf. Administrators must not authorize the use of your Merchant Account or the Services by any Prohibited Person.

Administrators must monitor your Merchant Account activity and statements as required by applicable Terms. Certain Services include additional permission levels and authorizations. If you use these Services, Administrators on your Merchant Account will be able to authorize and assign Users these permission levels and authorizations.

Bookkeepers

You may authorize individuals to have read-only “bookkeeper access” to certain information. These individuals may view and run reports and download statements.

Users

Users may use your Merchant Account, transact, and use the Services only for valid, lawful, bona fide business purposes on Merchant’s behalf in accordance with the permissions assigned by your Administrator. Users may not use the Services for personal, family, or household purposes. Users must accept and comply with the Terms.

2.2 Responsibility for Use

Merchant is responsible and liable for any actions or failure to act on the part of Administrators, Users, and those using Credentials issued to Users to access your Merchant Account.

Merchant is responsible for:

- Ensuring that Users are aware of and agree to abide by the Platform Agreement, the applicable Terms, and all applicable law and Program Partner rules in connection with their use of the Services

- Obtaining appropriate consent and authorization to provide Users’ personal information, and ensuring that Users are aware of and have reviewed the Privacy Policy and understand how we process their personal information

- Ensuring that Users are aware of, accept, and comply with the Terms

- Ensuring that Users use the Services only for valid, lawful business purposes and not for any personal, family, or household use

Merchant is liable for any breach or violation by its Users of this Platform Agreement or any of the agreements, terms, and policies incorporated by reference.

Merchant is responsible for ensuring that Administrators, Users, and any other persons affiliated with Merchant communicate respectfully and will refrain from using any form of disrespectful, harassing, abusive, or hate speech with our team members. If we receive reports of any such behavior by representatives of your Merchant towards our team, we may contact your Administrator, suspend access to your Merchant Account and the Services, or close your Merchant Account.

2.3 Access

Safeguards and Credentials

Safeguards and Credentials

You will keep your Merchant Account secure and only provide access to individuals that you have authorized to use the Services on your behalf. You will take all reasonable steps to safeguard the privacy, confidentiality, and security of User Credentials. You will closely and regularly monitor the activities of Users who access the Services, and you will use all reasonable means to protect checks, mobile devices, web browsers, and anything else used to access or use the Services.

You will ensure that each User has their own unique set of Credentials, keeps those Credentials secure, does not share those Credentials with any other person or third party, and follows commercially acceptable security practices concerning the reuse of Credentials for other services, which optimally includes the use of a password manager.

You will not allow any unauthorized person to use the Services. You will immediately disable User access to the Services or limit permissions where you know or suspect your Merchant Account has been compromised or may be misused or where you know or believe a User’s Credentials are compromised or lost; and you will promptly notify us of any unauthorized access or use of your Merchant Account or the Services.

Security Procedures

We have implemented technical and organizational measures designed to secure any of your personal information that we process or store from accidental loss and from unauthorized access, use, alteration, or disclosure. Our Program Partners also store personal information as part the Services. Despite the security measures taken by us and our Program Partners, we cannot guarantee that unauthorized third parties will never be able to defeat those measures or use your personal information for improper purposes. You provide your personal information at your own risk.

You are responsible for safeguarding your password and for restricting access to the Services from your compatible mobile devices and computer(s) and implementing security procedures in connection with your use of the Services to mitigate your exposure to potential security incidents. This responsibility includes selecting appropriate administrative, procedural, and technical controls that are appropriate to protect your financial accounts. You will immediately notify us of any unauthorized use of your password or Merchant Account or any other breach of security. Notwithstanding Sections 3.5 and 3.6, in the event of any dispute between two or more parties as to account ownership, we will be the sole arbiter of such dispute in our sole discretion. Our decision (which may include termination or suspension of any Merchant Account subject to dispute) will be final and binding on all parties.

2.4 Transactions and Activities

Though we may provide recommended security procedures, we cannot guarantee that you will not become a victim of fraud. You are solely responsible for all transactions initiated through the Services using Credentials and for all transactions initiated in your name that are authenticated using whatever security procedures that you choose.

You will be bound by any transaction (including any transfer, instruction, or payment order we receive related to the Services), even if it is not authorized, if the transaction is initiated under your Credentials or processed in accordance with your instructions.

We may help you resolve unauthorized transactions, but you acknowledge and understand that you are responsible for any financial loss caused by Administrators, Users, or other persons given access to the Services or your Merchant Account, and any financial for loss due to compromised Credentials or due to any unauthorized use or modification of your Merchant Account or the Services. We are not liable or responsible to you, and you waive any right to bring a claim against us, for any such losses.

We may suspend access to your Merchant Account or the Services at any time and for any reason, in our sole and absolute discretion, without prior Notice. Some of the reasons we may suspend access to your Merchant Account include: if we believe your Merchant Account has been compromised; if we believe that not doing so may pose a risk to you, us, or any third parties; if Merchant Data or Personal Data is incomplete, inaccurate, or out of date; if we believe you have violated this Platform Agreement or the law; or if we are required to do so by a Program Partner or by law.

Your Merchant Account is commercial in nature, and you acknowledge and understand that certain consumer protection laws and consumer-specific rules (including NACHA rules specific to consumers) do not apply to transactions on your Merchant Account or your use of the Services.

2.5 Fees and Disclosures

Fees

We may assess Fees for some Programs or Services, including periodic fees, usage fees, service fees, and fees applicable to certain transactions or subscription services. We may also assess Fees for late or failed subscription payments, or misuse of your Merchant Account or the Services. The amount of Fees may be contingent on the volume of payments that you process through MONESQ. We will disclose Fees to you when opening your Merchant Account, when you start using a new Service, or through our website. We may update, add, or change Fees upon 30 days’ Notice to you.

Any accrued or incurred Fees will be reflected on your statements for the applicable Service and included in the amounts you owe us under such Service.

Disclosures about the Services

Some Services provided by us may require use of other Programs or Services. We do this because some of our Services serve as a way to access other Services. We will disclose any such required additional Programs or Services to you before you use such Programs or Services.

2.6 Changes to the Services

We may add Services or modify existing Services at any time. Some of these Services will be subject to Additional Terms. You acknowledge and understand that in order to use certain Services, you must agree to the Additional Terms that we will provide separately from this Platform Agreement, and which will be incorporated by reference and form a part of this Platform Agreement.

We do not guarantee that each of the Services will always be offered to you, that they will be available to you, or that you will qualify or be able to use any particular Service. Services will change from time to time, and certain Services may be discontinued or others may be added.

2.7 Notices and Communications

We will provide Notices regarding certain activity and alerts to your Merchant Account electronically through your Merchant Account or email to the contact information provided to us by Administrators and Users.

Notices regarding payments, legal terms, and any other important Notices related to your Merchant Account will be sent to certain Administrators through your Merchant Account or email and are considered received 24 hours after they are sent. You understand that you may not use the Services unless you consent to receive Notices electronically. You may only withdraw consent to receive Notices electronically by closing your Merchant Account.

We may in the future send Notices to Users’ mobile phones through push notifications, text or SMS messages to the mobile phone numbers provided to us by Administrators or Users. These Notices may include alerts about Services or transactions, and may allow Administrators and Users to respond with information about transactions or your Merchant Account. You authorize Users to take any available actions, subject to limitations based on permissions and authorization.

We may send email messages to Users in connection with use of Credentials (such as through multi-factor authentication), to allow us to verify their identity, to provide other information about your Merchant Account or in connection with Programs, and for other purposes that we identify and that are available through your Merchant Account.

Administrators and Users are required to maintain updated web browsers, computers and, if applicable, mobile device operating systems to receive Notices correctly. Administrators and Users are responsible for all costs imposed by their respective Internet or mobile service providers for sending or receiving Notices electronically.

Contact us immediately if you are or believe you are having problems receiving Notices.

2.8 Updates to Merchant Information

Providing information

You will keep Merchant data and each User’s personal data current, complete, and accurate in your Merchant Account at all times whether we provide you with full or provisional access.

At any time during the term of this Platform Agreement and your use of the Services, we or Program Partners may require additional information from you, including Merchant data (such as copies of government-issued identification, business licenses, or other information related to your business) and personal data (such as copies of government-issued personal identification and proof of address) to verify Beneficial Owners or Control Persons, validate information you provided, verify the identity of Administrators or Users, and assess Merchant’s financial condition and business risks.

Notification of corporate and business changes

You will promptly notify us in writing if any of the following occur:

- The nature of your business changes significantly

- There is any change of Beneficial Owners or Control Persons

- There is any material change in the control or ownership of your business (whether direct or indirect) or you transfer or sell 25% or more of your total assets

- There is any planned or anticipated liquidation, or voluntary bankruptcy or insolvency proceeding

- You are the subject of an inquiry, proceeding, investigation, or enforcement action promulgated by any regulatory authority

- You are party to a litigation in which claims are asserted that would, if sustained in a legal proceeding or alternative dispute resolution forum, result in a material impact to Merchant’s financial condition

- You begin engaging in any of the Prohibited Activities or Restricted Activities

2.9 Our Property and Licenses

We and our licensors own all Company Property. Merchant, Administrators, and Users may use Company Property only as and for the purposes provided in this Platform Agreement and the Terms. You may not modify, reverse engineer, create derivative works from, or disassemble Company Property or register, attempt to register, or claim ownership in Company Property or portions of Company Property.

We grant you a nonexclusive and nontransferable license to use Company Property as provided through the Services and as permitted by this Platform Agreement. This license terminates upon termination of this Platform Agreement unless terminated earlier by us.

We will not share any Merchant Data with third parties for marketing unaffiliated products without your consent, but may use Merchant Data to identify Services, Third-Party Services, and programs that we believe may be of interest to you. We may include De-Identified Data in both public and private reports.

You grant us a worldwide, irrevocable license to use, modify, distribute, copy, and create derivative works from Merchant data for the purposes identified in this Platform Agreement.

2.10 Identification as Customer

We may publicly reference you as our customer on our website or in other communications during the term of this Platform Agreement. We will not express any false endorsement or partnerships. You grant us a limited license to use Merchant trademarks or service marks for this purpose. Please notify us if you prefer that we not identify you as our customer, and we will remove references to you on our website or in other communications.

2.11 Beta Services and Feedback

We sometimes release Beta Services in order to test new products, features, and programs, and we may make these Beta Services available to you to get your Feedback. We may change or discontinue Beta Services at any time. Beta Services are confidential until we publicly announce the products, features, or programs, and if you use Beta Services, you agree to keep information about the Beta Services confidential. Any Beta Services are provided to you AS IS and without warranty. We may use any Feedback about the Services or Beta Services freely and without restriction. Except where specifically notified by us, we will not compensate or credit you for Feedback you provide to us.

2.12 Content

Information provided on our website and in other communications from us is for information purposes only. We believe it to be reliable, but it may not always be entirely accurate, complete or current. We may change or update information from time to time without Notice. You should verify all information on our website and in other communications from us before relying on it. You are solely responsible for all of your decisions based on information provided on our website and in other communications from us, and we have no liability for such decisions.

Information we provide on our website and in other communications to you may contain third-party content or links to third-party sites and applications. We do not control any such third-party content, sites, or applications, and we are not responsible or liable for the availability, accuracy, completeness, or reliability of third-party content or for damages, losses, failures, or problems caused by, related to, or arising from such third-party content or the products or practices of third parties.

You grant us and our affiliates and successors a worldwide, non-exclusive, royalty-free, fully-paid, transferable, irrevocable, perpetual, and sublicensable right to use, in order to provide any Service, any information that you upload or post to the Platform and any information provided by you to us in connection with any Service, including, without limitation, information about your Users or any clients that access any client portals provided by a Service. You retain all rights in such content, subject to these rights granted to us. You may modify or remove your content via your account or by terminating your account, but certain of your content may persist in historical, archived, or cached copies and versions thereof available on or through the Services. If you terminate your account, it is your responsibility to download and archive any records that you need to comply with applicable rules and regulations, such as law firm financial and client records, including trust accounting records.

2.13 Assignment

You may not transfer or assign (by operation of law or otherwise) this Platform Agreement or any of your rights or obligations hereunder, or operation of your Merchant Account, without our prior express written consent. If you wish to make such a transfer or assignment, or the ownership of Merchant is changing, you must give us prior written notice. If we consent to such a transfer or assignment, the assignee or successor must assume all of Merchant’s rights, obligations, and liabilities under this Platform Agreement, and will be bound by all the terms of this Platform Agreement. We may assign, pledge, or otherwise transfer this Platform Agreement or any of our rights and powers under this Platform Agreement without restriction and without providing Notice to you. Any such assignee or successor will have all rights as though originally named in this Platform Agreement instead of us.

2.14 Term and Termination

This Platform Agreement is effective when you start an application for a Merchant Account or otherwise use any Service, and continues until terminated by either you or us, in accordance with the Terms or as set forth in this Platform Agreement.

You may terminate this Platform Agreement by ceasing to use the Services, paying all amounts owed, and providing notice to us. We may decline to close your Merchant Account if you have a negative balance in respect of any Service, if any funds that we are holding on your behalf are subject to a hold, lien, or other restriction, or if we believe that the Merchant Account is being closed to evade any legal or regulatory requirement or investigation.

We may terminate this Platform Agreement and terminate access to your Merchant Account or the Services at any time and for any reason by providing you Notice. If we believe you violated this Platform Agreement or the applicable Program Terms, or if required by one of our Program Partners or by law, we may terminate access to your Merchant Account without prior Notice.

You are responsible for all Charges, Fees, Fines, and other losses caused by your action or inaction prior to termination, and for any costs we may incur in the process of closing your Merchant Account upon termination by you or us.

In the event that this Platform Agreement is terminated, except as expressly provided herein, the applicable Terms will immediately terminate (other than sections that survive termination).

If you reapply or reopen your Merchant Account or use or attempt to use any of the Services, you are consenting to the Platform Agreement in effect at that time.

Sections 1.3 (Data and Privacy), 2.2 (Responsibility for Use), 2.3 (Access), 2.4 (Transactions and Activities), 2.7 (Notices and Communication), 2.11 (Beta Services and Feedback), 2.13 (Assignment), 2.14 (Term and Termination), 3.2 (Limitation of Liability), 3.3 (Disclaimer of Warranties by Company), 3.4 (Indemnification), 3.5 (Governing Law and Venue), 3.6 (Binding Arbitration), and 3.7 (Legal Process) together with the provisions of the Program Terms that identify continuing obligations, and all other provisions of this Platform Agreement or the agreements, terms, and policies incorporated herein giving rise to continuing obligations of the parties, will survive termination of this Platform Agreement.

2.15 Third Party Services and Websites

You may be offered services, products and promotions provided by third parties and not by us (“Third Party Services”). If you decide to use Third Party Services, you will be responsible for reviewing and understanding the terms and conditions for these services. We are not responsible or liable for the performance of any Third Party Services. Further, you agree to resolve any disagreement between you and a third party regarding the terms and conditions of any Third Party Services with that third party directly in accordance with the terms and conditions of that relationship, and not us. The Services may contain links to third party websites. The inclusion of any website link does not imply an approval, endorsement, or recommendation by us. Such third party websites are not governed by the Platform Agreement. You access any such website at your own risk. We expressly disclaim any liability for these websites. When you use a link to go from the Services to a third party website, our Privacy Notice is no longer in effect. Your browsing and interaction on a third party website, including those that have a link in the Services is subject to that website’s own terms, rules and policies, including with respect to privacy.

3. General Provisions

3.1 Intellectual Property Infringement

We respect the intellectual property rights of others and ask you to do the same.

3.2 Limitation of Liability

We are not liable to you for consequential, indirect, special, exemplary, or punitive damages, lost profits, or lost revenue arising from or related to your use of or inability to use Services or processing, lost profits or reputational harm, physical injury or property damage, or any other losses or harm arising from or related to this Platform Agreement or any terms, agreements, or policies incorporated by reference, whether or not we were advised of their possibility by you or third parties.

Our maximum liability to you under this Platform Agreement and any terms, agreements, or policies incorporated by reference, is limited to the greater of the total amount of Fees actually paid by you to us in the three months preceding the event that is the basis of your claim or $5,000. These limitations apply regardless of the legal theory on which your claim is based.

3.3 Disclaimer of Warranties

THE SERVICES, COMPANY PROPERTY, AND BETA SERVICES ARE PROVIDED TO YOU AS IS AND AS AVAILABLE. THE COMPANY DISCLAIMS ALL EXPRESS, IMPLIED, OR STATUTORY WARRANTIES OF TITLE, MERCHANTABILITY, OR FITNESS FOR A PARTICULAR PURPOSE, AND ALL WARRANTIES OF NON-INFRINGEMENT OF THE SERVICES, COMPANY PROPERTY, AND BETA SERVICES. NOTHING IN THIS PLATFORM AGREEMENT WILL BE INTERPRETED TO CREATE OR IMPLY ANY SUCH WARRANTY TO YOU.

THIRD-PARTY SERVICES ARE NOT PROVIDED OR CONTROLLED BY THE COMPANY. WE DO NOT PROVIDE SUPPORT FOR AND DISCLAIM ALL LIABILITY ARISING FROM FAILURES OR LOSSES CAUSED BY THIRD-PARTY SERVICES.

WE DISCLAIM ALL WARRANTIES AND DO NOT GUARANTEE THAT (A) SERVICES AND DATA PROVIDED UNDER THIS PLATFORM AGREEMENT ARE ACCURATE OR ERROR-FREE; (B) THE SERVICES WILL MEET YOUR SPECIFIC NEEDS OR REQUIREMENTS; (C) THE SERVICES WILL BE USABLE BY MERCHANT, ADMINISTRATORS, OR USERS AT ANY PARTICULAR TIME OR LOCATION; (D) SERVICES WILL BE UNINTERRUPTED, SECURE, OR FREE FROM HACKING, VIRUSES, OR MALICIOUS CODE; AND (E) ANY DEFECTS IN THE SERVICES WILL BE CORRECTED, EVEN WHEN WE ARE ADVISED OF SUCH DEFECTS.

WE ARE NOT LIABLE FOR AND DISCLAIM LIABILITY FOR ANY DAMAGES, HARM, OR LOSSES TO YOU ARISING FROM UNAUTHORIZED ACCESS OR USE OF YOUR MERCHANT ACCOUNT OR THE SERVICES OR YOUR FAILURE TO IMPLEMENT APPROPRIATE SECURITY PROCEDURES.

3.4 Indemnification

You agree to indemnify, defend, and hold harmless us and Third-Party Service Providers and Program Partners (including our and their respective affiliates, directors, employees, agents, and representatives), from and against all losses, liabilities, claims, demands, or expenses, including reasonable attorneys’ fees, arising out of or related to: proceedings, suits, or actions brought by or initiated against us by any third party due to your breach or alleged breach of this Platform Agreement, any terms, agreements, or policies incorporated by reference, or any other agreements with us; acts or omissions of Administrators, Users, or other Merchant employees or agents; Merchant’s actual or alleged infringement of a third party’s intellectual property rights; Merchant’s use of Third-Party Services; or disputes over Charges.

3.5 Governing Law and Venue

This Platform Agreement will be construed, applied, and governed by the laws of the State of Texas exclusive of its conflict or choice of law rules except to the extent that U.S. federal law controls. Subject to the good faith binding arbitration requirement provisions contained in Section 3.6, all litigation will be brought in the state or federal courts located in Travis County, Texas.

3.6 Binding Arbitration

You agree with us to resolve all Disputes arising under or in connection with this Platform Agreement as provided in this section. Any arbitration or other legal proceeding under this Platform Agreement will only be on an individual basis. Neither party may join with other parties to form a Consolidated Action. Each party waives its rights to file a lawsuit in court, to have its case decided by a jury, and to participate in a Consolidated Action against the other party.

If you do not want to arbitrate all claims as provided in this Platform Agreement, then you have the right to reject such arbitration provisions by delivering a written notice to us at 7300 Ranch Road 2222, BLDG 2-260, Austin, TX 78730 Attention: Legal Department, within thirty (30) days of the date you have entered into this Platform Agreement. Your rejection of any arbitration provisions does not affect any independent arbitration agreements with third parties, and you remain subject to any arbitration, class action, or jury trial waiver or dispute resolution processes set out in those separate agreements.

You agree to first attempt to resolve Disputes in good faith and in a timely manner. Where no resolution can be found, Disputes will be resolved by arbitration in Austin, Texas before a single arbitrator, as provided in this section, except that Disputes principally arising from protection of intellectual property rights or breach of confidential information will be resolved through litigation in accordance with Section 3.5

Arbitration will be administered by JAMS according to the rules and procedures in effect at the time the arbitration is commenced. Disputes with amounts claimed greater than $250,000 will apply the JAMS Comprehensive Arbitration Rules and Procedures, and Disputes with amounts claimed less than or equal to $250,000 will apply the JAMS Streamlined Arbitration Rules. The arbitrator will apply the substantive law as described in Section 3.5 if JAMS cannot administer the Dispute, either party may petition the US District Court for the Western District of Texas to appoint an arbitrator. The parties acknowledge that transactions under this Platform Agreement may involve matters of interstate commerce and, notwithstanding the provisions in this paragraph referencing applicable substantive law, the Federal Arbitration Act (9 U.S.C. §§ 1-16) will govern any arbitration conducted pursuant to the terms of this Platform Agreement.

Either party may commence arbitration by providing a written demand for arbitration to JAMS and the other party detailing the subject of the Dispute and the relief requested. Each party will continue to perform its obligations under this Platform Agreement unless that obligation or the amount (to the extent in Dispute) is itself the subject of the Dispute. Nothing in this Platform Agreement affects the right of a party to seek urgent injunctive or declaratory relief from a court of appropriate jurisdiction in respect of a Dispute or any matter arising under this Platform Agreement.

The prevailing party is entitled to recover its reasonable attorneys’ fees, expert witness fees, and out-of-pocket costs incurred in connection with such proceeding, in addition to any other relief it may be awarded.

Proceedings and information related to them will be maintained as confidential, including the nature and details of the Dispute, evidence produced, testimony given, and the outcome of the Dispute, unless such information was already in the public domain or was independently obtained. Each party agrees that all witnesses, advisors, and arbitrators will only share such information as necessary to prepare for or conduct arbitration or other legal proceeding, or enforcement of the outcome, unless additional disclosure is required by law.

Any action or proceeding by you relating to any Dispute must commence within one year after the cause of action accrues.

3.7 Legal Process

We may respond to and comply with any legal order we receive related to your use of the Services, including subpoenas, warrants, or liens. We are not responsible to you for any losses you incur due to our response to such legal order. We may take any actions we believe are required of us under legal orders including holding funds or providing information as required by the issuer of the legal order. Where permitted, we will provide you reasonable Notice that we have received such an order.

3.8 Headings and Interpretation

Headings in this Platform Agreement are for reference only. Except where otherwise specified, all references to sections or provisions refer to this Platform Agreement or the applicable incorporated terms. The phrases including, for example, or such as do not limit the generality of the preceding provision; the word or will be read to mean either… or… or any combination of the proceeding items; words in the singular include the plural and words in the plural include the singular; and provisions listing items and using and require all listed items.

If any provision of this Platform Agreement is found by a court of competent jurisdiction or arbitrator to be unenforceable or invalid, that provision will be limited or eliminated to the minimum extent necessary so that this Platform Agreement will otherwise remain in full force and effect.

3.9 Waivers

Any waiver, modification, or indulgence that we provide to you, of any kind or at any time, applies only to the specific instance involved and will not act as a general waiver or a waiver, modification, or indulgence under this Platform Agreement for any other or future acts, events, or conditions. Further, any delay by us in enforcing our rights under this Platform Agreement does not constitute forfeiture of such rights.

3.10 Entire Agreement

This Platform Agreement, including any terms, agreements, or policies incorporated by reference, constitutes the entire understanding of the parties with respect to the subject matter described and supersedes all other proposals or previous understandings, written or oral, between the parties. No other agreements, representations, or warranties other than those provided in this Platform Agreement and the applicable terms will be binding unless in writing and signed by us and you.

3.11 California Businesses

If you are a “Business” as defined by the California Consumer Privacy Act of 2018, Cal. Civ. Code § 1798.100 et seq., (“CCPA”) then this Section 3.11 applies to you. For purposes of this Section 3.11, “process”, “sell”, and “business purpose(s)” have the meaning ascribed to them by the CCPA.

For purposes of this Section 3.11, “Buyer Personal Information” means any information that identifies, relates to, describes, is reasonably capable of being associated with, or could reasonably be linked, directly or indirectly, with a particular consumer or household that is processed by us in connection with its Services to you.

We may receive Personal Information from your customers for the purpose of performing Services on your behalf as described in the Platform Agreement. We agree that we will process Buyer Personal Information collected, processed, stored or transmitted by, or accessible to us in the course of this Program Agreement, only on your behalf, and for the purpose of providing you with the Services. We acknowledge that we are prohibited from: (i) selling the Buyer Personal Information; or (ii) retaining, using, or disclosing the Buyer Personal Information for any purpose other than providing to you the Services specified in the Platform Agreement. As part of, and for purposes of, facilitating the Services, we may (i) de-identify or aggregate the Buyer Personal Information; and (ii) process the Buyer Personal Information for operational purposes, including, without limitation, verifying or maintaining the quality and safety of the Services; improving, updating or enhancing the Services either for you or for our customers generally; detecting and preventing fraud, and for protecting the security and integrity of our Services; and complying with our legal obligations. You acknowledge and agree that Buyer Personal Information that you disclose to us is provided to us for the parties’ business purposes.

We reserve the right to delete Personal Data stored pursuant to the Platform Agreement in the ordinary course of business, pursuant to our retention schedules.

4. Defined Terms

Capitalized terms in this Platform Agreement are defined as follows:

Additional Terms means additional terms or policies to which we may require you to agree in the event that we release new products, features, integrations, promotions, or rewards, or otherwise to enhance and improve the scope and quality of the Services.

Administrator means an individual with the requisite organizational power and authority to conduct business and manage the Merchant Account and act on behalf of Merchant, including consenting to this Platform Agreement.

Beneficial Owner means any individual who, directly or indirectly, owns 25% or more of the equity interests of Merchant.

Beta Services means beta or pre-release products or services, which may contain features and functionality that are incomplete or subject to substantial change or discontinuation.

Company Data means all data developed or collected by us through the development or provision of Services, or Third-Party Services, or generated or recorded by Platform, but which does not include Merchant Data.

Company Property means the Services and related technology; Company Data; and copyrights, patents, trade secrets, trade or service marks, brands, logos, and other intellectual property incorporated into each of the foregoing.

Card Networks means the payment card networks including Visa or Mastercard.

Consolidated Action means class arbitrations, class actions, or other action brought between multiple parties based on the same or similar legal claims, or the same or similar facts.

Control Person means an individual with significant responsibility to control, manage, or direct Merchant.

Credentials means usernames, passwords, and other identifiers or credentials used to assist the Company in identifying and authenticating you with regard to your use of the Services.

De-Identified Data means data derived from Merchant Data that has been anonymized or aggregated with other data and that can no longer be used to identify a specific Merchant or individual.

Dispute means any dispute, claim, or controversy arising from or relating to this Platform Agreement, including any incorporated terms, agreements, and policies.

Feedback means all feedback, suggestions, ideas, or enhancement requests you submit to us.

Fees means charges we and/or our Program Partners impose on you for use of Services or transactions in your Merchant Account.

Financial Data means Merchant’s bank information, transaction, and account information accessible to the Company through Linked Accounts or Third-Party Services.

Fines means all fines, penalties, or other charges imposed by a Program Partner, governmental agency or regulatory authority arising from your breach of this Platform Agreement, any of the Terms, Card Network rules, or other agreements you have with us or a Program Partner.

Linked Account means any depository account that is held with a financial institution and that is linked to or authorized to make or receive payments through your Merchant Account.

Merchant Account means your Merchant’s account that is used to access the Services, including the receipt of online payments through us and Program Partners.

Merchant Data means information or documentation provided by Merchant to the Company, and which includes Financial Data and any Personal Data provided by Merchant, Administrators, and Users.

Notice means any physical or electronic communication, or legal notices related to this Platform Agreement that are provided to you, Users, or Administrators through text or SMS, email, your Merchant Account, or by other means.

Personal Data means data that identifies or could reasonably be used to identify a natural person.

Platform Agreement means this Platform Agreement as amended.

Professional Website means the website we enable you to create for your firm through the Services.

Program Partner means a bank, financial institution, payment facilitator, or other partner that provides services directly related to one or more Services.

Terms means the terms and agreements applicable to portions of the Services, any Program Partner terms, and any other terms and conditions that govern access to and use of any Services.

Services means the Free Service (including Invoicing & Payments), the Plus Service (including Time & Expense Tracking and Trust Accounting), and any other financial solutions or services offered or operated by us.

Prohibited Activities are those activities listed in Section 2 of this Platform Agreement.

Prohibited Person means any individual or organization that is subject to sanctions in the United States, identified on any lists maintained by OFAC or the U.S. Department of State, or is subject to any law, regulation, or other list of any government agency that prohibits or limits us from providing a Merchant Account or Services to such person or from otherwise conducting business with the person.

Third-Party Services means services and data provided by third parties connected to or provided through the Services. Third-Party Services include accounting or expense management platforms (such as QuickBooks Online), eSignature platforms (such as Dropbox Sign), payment processors, storage applications, and applications used to monitor Linked Accounts.

Third-Party Service Provider means an affiliate or other third party that assists us in providing the Services to you, that supports our internal operations, or that provides other services related or connected to, or provided through the Services and a Merchant Account, including Third-Party Services.

Users means any employees, contractors, partners, shareholders, view only users, or agents authorized to use or access the Services on Merchant’s behalf, and includes Administrators.

Website means the websites and services available from the domain and sub-domains https://monesq.com; https://secure.monesq.com; https://securesite.legal (provided to you through our professional website service), and any related or successor domains and mobile applications and sites from which we may offer the Services.

USER TERMS FOR MONE$Q® FREE

- MONESQ Free Service. The following terms apply to the MONESQ FREE Service (the “Service”) which includes, among other things, invoicing and payments.

- Registration and Account Creation. To use the Service, you must register with us and provide an email address and a self-selected password to create a Merchant Account, as described in the Platform Agreement.

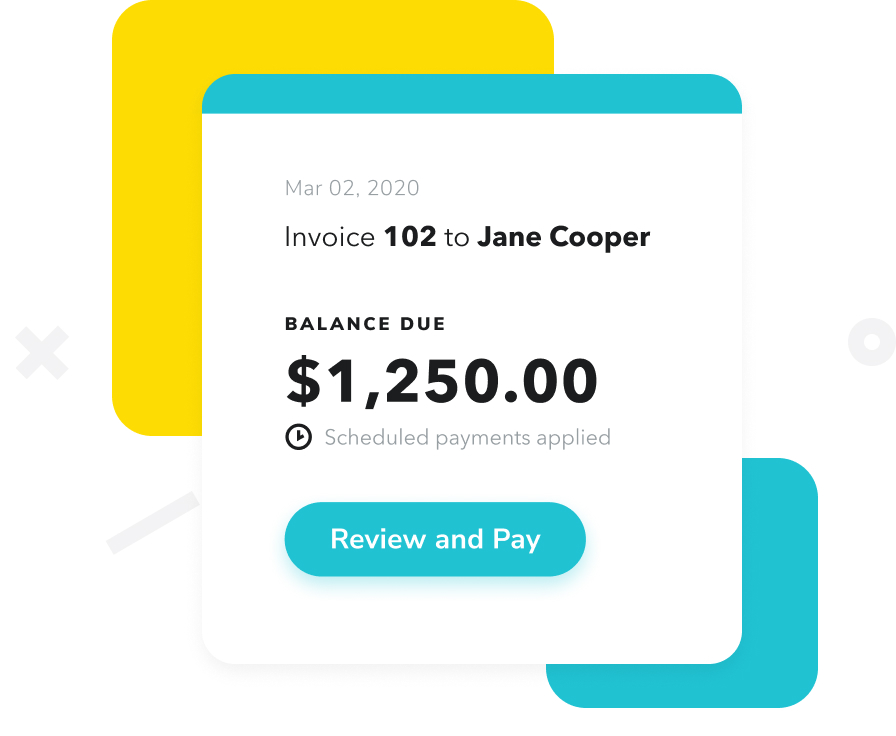

- Payment Partners. The Service facilitates receipt by Merchant customers (“Merchants”) of payments by credit cards, debit cards, and bank transfer (eCheck). These transactions are between Merchants and persons who pay them (“Purchasers”). We are not a party to these transactions. For payments by card, we initiate the payment process by providing information to a payment facilitator (“Payfac”). The Payfac is not a bank and to facilitate the payment services enters into agreements with card networks, processors, and acquiring banks. The Payfac sends card information to a bank that is a member of Visa U.S.A. International (“Visa”), Mastercard International Incorporated (“MasterCard”), American Express Travel Related Services Company Inc. (“American Express”), or other payment card networks, associations, or companies. The bank is obligated to pay Merchants under both (a) the provisions of its agreement with the Payfac; and (b) the by-laws, operating regulations and all other rules, policies, and procedures of the card networks as in effect from time to time (the “Network Rules”). For payments by eCheck, we initiate the payment process by providing information to the Payfac, which provides information to a bank through the National Automated Clearing House (“ACH”). To use the Service, you must agree to the Stripe Connected Account Agreement. See Payment Partners.

- Limitations. Neither we nor any third party makes any representations or guarantees regarding Merchants or Purchasers using the Service. We do not have control of, or liability for, goods or services that are paid for with the Service.

- Fees. Merchants pay transaction fees as set forth in the Stripe Connected Account Agreement. Merchants may also be subject to recurring subscription fees for the Service. These fees may be contingent on the volume of payments processed by a Merchant.

- Requirements For Service. You will need a computer or mobile device, internet connectivity, and an updated browser to access our website and receive communications relating to the Service.

- Security. The Payfac is a Level 1 Certified Payment Service Provider and is required to comply with the applicable provisions of the Payment Card Industry Data Security Standards (“PCI-DSS”). If you use the Service to accept payment card transactions, you must also comply with PCI-DSS and all other applicable security standards. We do not see or store Purchaser cardholder account numbers – these are passed in encrypted form to the Payfac.

USER TERMS FOR MONE$Q® PLUS

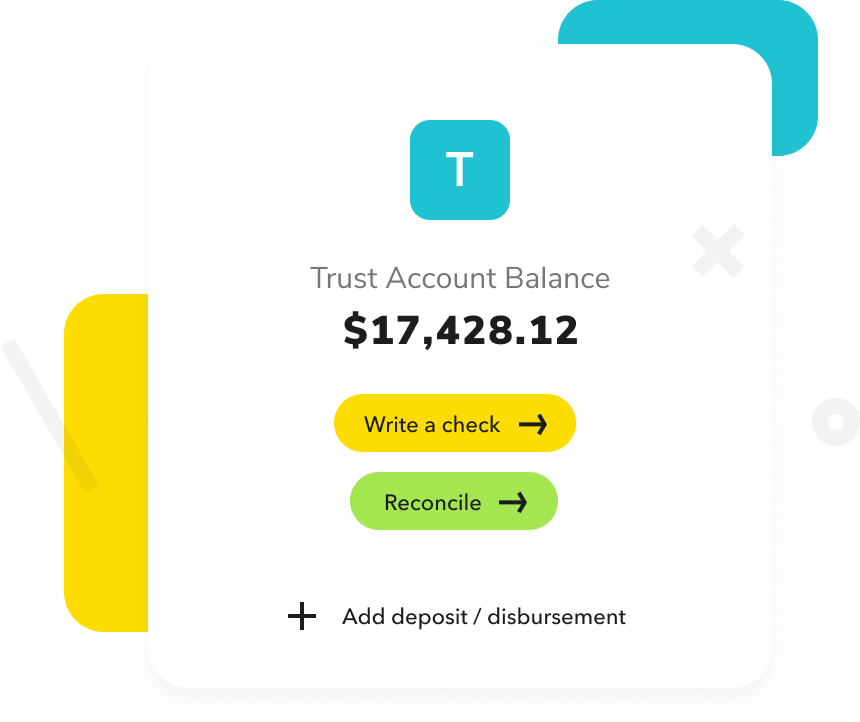

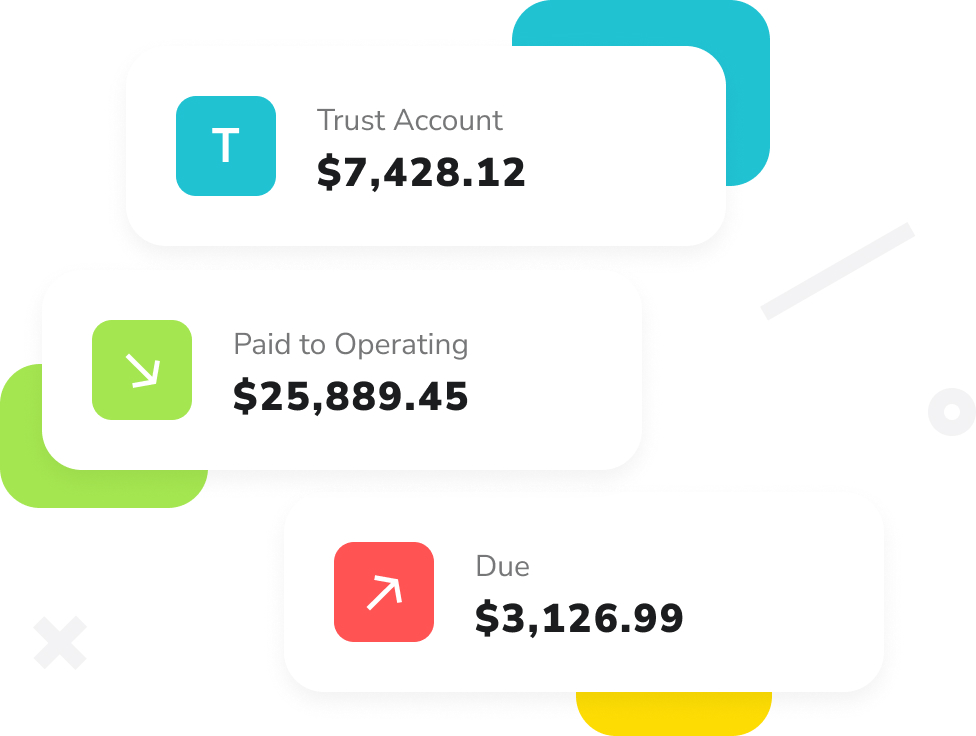

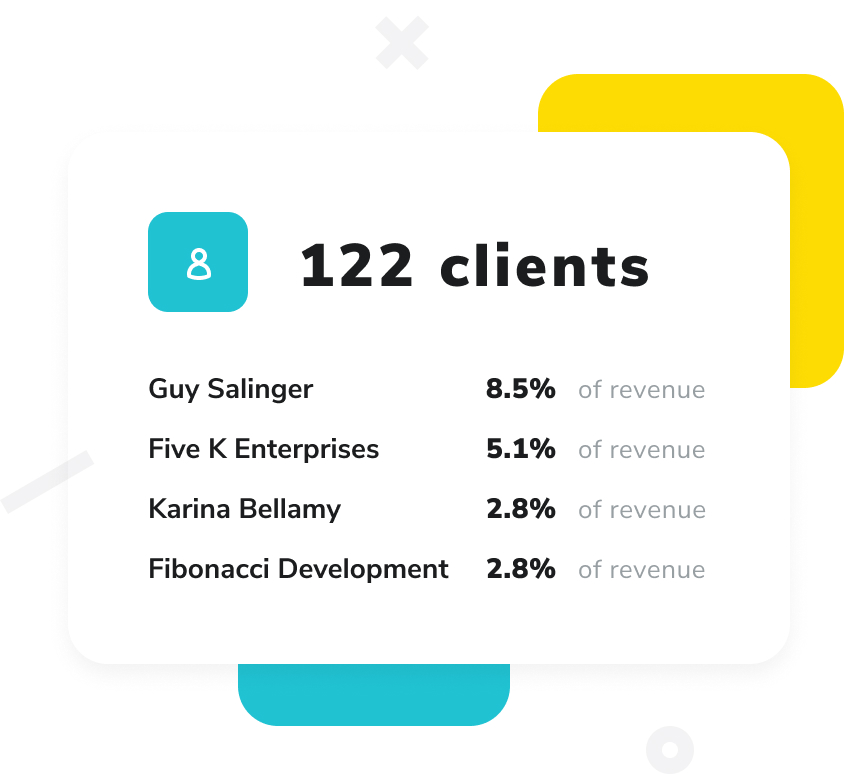

- MONESQ Plus Service. The following terms apply to the MONESQ PLUS Service (the “Service”) which includes, among other things, the features in the MONESQ FREE Service, as well as time and expense tracking, trust accounting, and advanced reporting.

- State Variations. We use one code base for all states. Users must be familiar with the requirements of their state. For example, Users must be familiar with the requirements of their state on such matters as (i) when funds are deemed to be collected funds and available to transfer from an IOLTA account; (ii) what level of attorney supervision or control is required for writing checks or transferring funds from an IOLTA account; (iii) reports required to be submitted to their state for an IOLTA account; and (iv) the frequency of required IOLTA account reconciliation. When configuration is available to conform to different requirements, Users must configure available settings to meet their requirements. We will highlight known features that require User review.

- Termination of Subscription. Upon termination or cancellation of a subscription, your content and archived data is available to your Administrator or a designated authorized user for a period of 90 days after such termination or cancellation. After 180 days from termination or cancellation of your subscription, all of your content and data will be irrevocably deleted, other than data that we are required by law to maintain. Upon termination or cancellation of a subscription, it is the Merchant’s responsibility to download or archive data required to meet record retention requirements, including the record retention requirements for trust accounts, which vary by state.

- Limitation of Liability. The limitation of liability contained in the Platform Agreement applies to any liabilities arising out of your use of the Service.

- Disclaimer of Warranties. The disclaimer of warranties in the Platform Agreement applies to your use of the Service.

- Technical Support.Technical support and training are available to authorized users with active subscriptions, as defined at monesq.com

- Other Limitations.

- We may at any time, and from time to time, modify or discontinue, temporarily or permanently, any feature associated with the Service, except that we will provide you with not less than 30 days’ notice of any modification that materially reduces the functionality of the Service. Continued used of the Service after any modification constitutes acceptance of the modification.

- We reserve the right to temporarily suspend access to the Service for operational purposes, including maintenance, repairs, or installation of upgrades, and will endeavor to provide no less than two business days’ notice prior to any such suspension. We will endeavor to minimize any disruption, but reserve the right to temporarily suspend operations without notice at any time to complete necessary repairs.

User Terms for Professional Website Service

- Professional Website Service: MONESQ offers a Professional Website service that enables firms to create and publish a professional website. You may customize and build your website prior to opening a merchant account. Your website may not be published, however, until you have an approved MONESQ merchant account. The merchant application’s identity verification process helps protect you and MONESQ from imposters who might try to create an unauthorized website. By creating a Professional Website, you understand and agree to the following:

- Your Professional Website Domain Name. When You create a Professional Website, you may use the securesite.legal domain that we host. If you have already registered your own domain with a third-party provider, you can connect that existing domain to your Professional Website. If you choose to connect your own domain to your Professional Website, you are responsible to ensure that you comply with any third-party terms and agreements with respect to your use of your own domain.

- By submitting content to publish on your Professional Website, you grant to us a world-wide, royalty-free, non-exclusive license to reproduce, modify, adapt, and publish your content solely for the purpose of displaying, distributing, and promoting your Professional Website. This license will also allow us to make any publicly-posted content available to third parties that we may select so that these third parties can analyze and distribute (but not publicly display) the content through their services.

- Your Content. Other than the content you license from us, you own the content published on your Professional Website, and you are entirely responsible for any harm resulting from the content published on your Professional Website. You are responsible for ensuring that the content that you publish is accurate, up to date, and legally compliant, and does not infringe any other’s intellectual property rights and you are solely responsible for determining what content to publish and modify. If you delete content, it will be removed from public view, but you acknowledge that we cannot control all caching or references to the content that may remain available. While we do not review or revise the content you choose to publish on your Professional Website, we reserve the right to remove any content that, in our discretion, violates these Terms. Without limiting the restrictions in the foregoing, materials you post to your Professional Website may not contain URLs or links to websites that compete with the Services; or URLs or links linking to or redirecting any payment, gateway, e-commerce, processor or other website or portal that facilitates issuing of invoices by you and/or payments to you.

- Publishing Testimonials. If you choose to publish testimonials on your Professional Website, you are responsible for obtaining the necessary consent from the person or entity (e.g., your client, peer, or colleague) prior to publishing the testimonial on your Professional Website.

- Web Traffic. We may use a third party, to measure your Professional Website’s audience and usage. By hosting your website through MONESQ, you authorize us to create third party audience measurement reports and other analytics.

- Prohibited Uses. You agree to not use the Professional Website service in a manner that violates these Terms, and in particular, any Prohibited and Restricted Activities.

- Without your consent, we will not display ads on your Professional Website.

- Attribution; Legal Terms. We reserve the right to display attribution text or links in your Professional Website footer or toolbar, attributing MONESQ. We also reserve the right to require you to display legal terms that protect MONESQ. These attributions and legal terms may not be altered or removed.

ADDITIONAL TERMS OF PAYMENT PARTNERS

Capitalized terms used in these Mobile Terms of Service and not defined in these Mobile Terms of Service are defined in the Platform Agreement.

If you use MONESQ FREE or MONESQ PLUS, payment processing is provided by Stripe, Inc. or its affiliates (“Payment Processor”), you are required to accept, the Stripe Connected Account Agreement including agreements and other documents referred to in such agreement (collectively, the “Payment Processing Agreement”), as modified by the Payment Processor in accordance with the Payment Processing Agreement. By using MONESQ, you agree to be bound by these terms of payment and the applicable terms of the Payment Processing Agreement

We pass certain information to Stripe as part of the Know Your Customer and Merchant boarding process. Please refer to Stripe’s Privacy Policy to see how Stripe processes any Personal Information.

If you have a Linked Account that is an IOLTA trust account, you agree that any chargebacks associated with such account will be charged to the Linked Account designated as your Operating Account. You agree and understand that you are responsible for all chargebacks, as provided in the Stripe Connected Agreement and this Platform Agreement.

Your use of MONESQ is subject to certain fees and surcharges communicated to you during the enrollment process. As a condition to processing payments through MONESQ and its payment partners, you agree to provide us with accurate and complete information related to your use of payments through MONESQ and authorize us to share such information and transaction information with the Payment Processor pursuant to our Privacy Policy. Transaction information from payors will be collected for processing of transactions by the Payment Processor in accordance with the Payment Processor’s terms applicable to the payments. To the extent permitted by law, we may collect any payment obligations that you owe under this Agreement by deducting the corresponding amounts from funds payable to you arising from the settlement of card transactions. Fees will be assessed at the time a transaction is processed and will be first deducted from the funds received for such transactions. If the settlement amounts are not sufficient to meet your obligations, we may charge or debit the bank account or credit card registered in your account for any amounts owed (and you agree to execute such additional directions in writing to permit us to do so, if required). In the event a payment chargeback or dispute occurs, you may be charged a dispute fee per occurrence. This Section does not permit MONESQ to debit your trust account for any reason. In addition to the amount due, delinquent accounts may be charged fees that are incidental to the collection of delinquent accounts and chargebacks including, but not limited to, collection fees, convenience fees, legal fees and expenses, costs of any arbitration or court proceeding, collection agency fees, any applicable interest, and third party charges. You hereby explicitly agree that all communication in relation to delinquent accounts will be made by electronic mail or by phone, at addresses and numbers provided to MONESQ. Such communication may be made by MONESQ or by anyone on its behalf, including, but not limited to, a third party collection agent. You will comply with the terms and conditions of any applicable merchant agreements and all applicable card network rules, policies, laws and regulations, at all times while using MONESQ and its payment partners for processing payments.