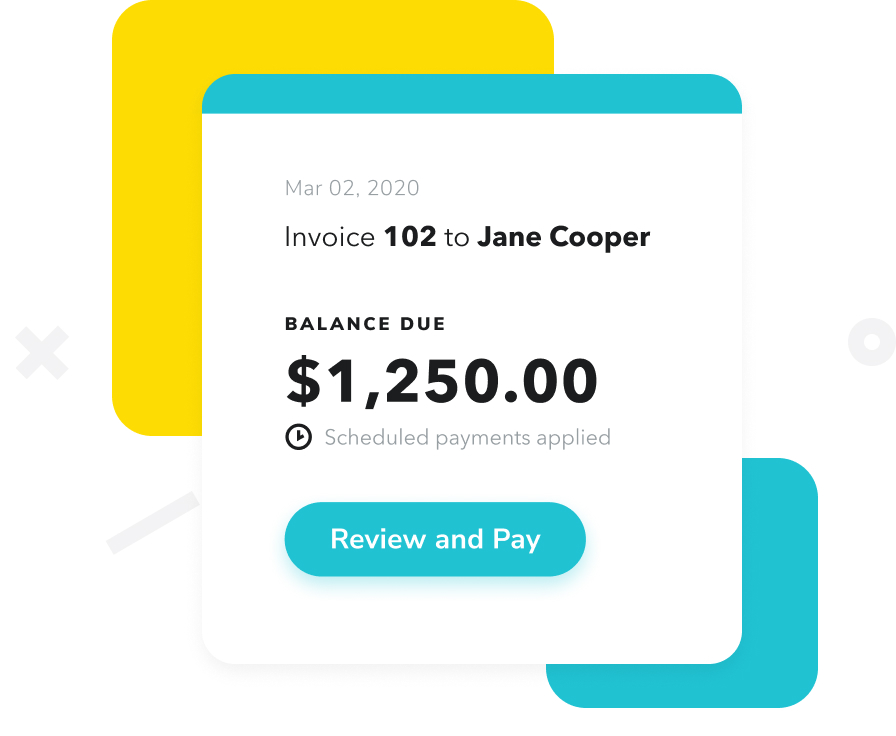

Legal Point of Payment is free and includes financial tools to invoice your clients and manage your receivables.

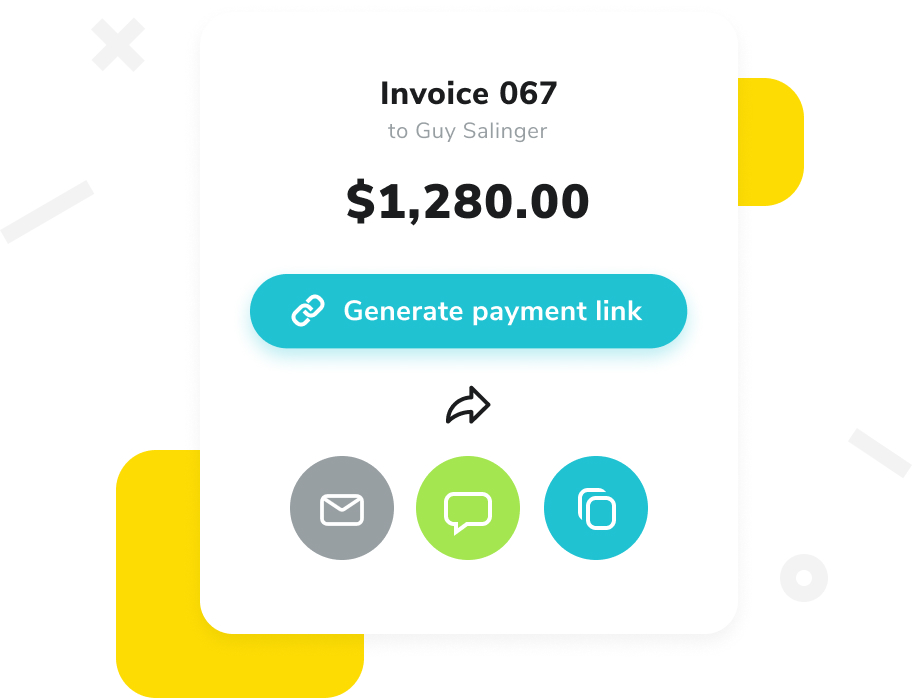

With our low flat rate payment processing, we provide your clients with a secure frictionless way to pay by credit card and eCheck from multiple devices. You will see the money in your account within 1-2 business days (3 business days for eCheck).

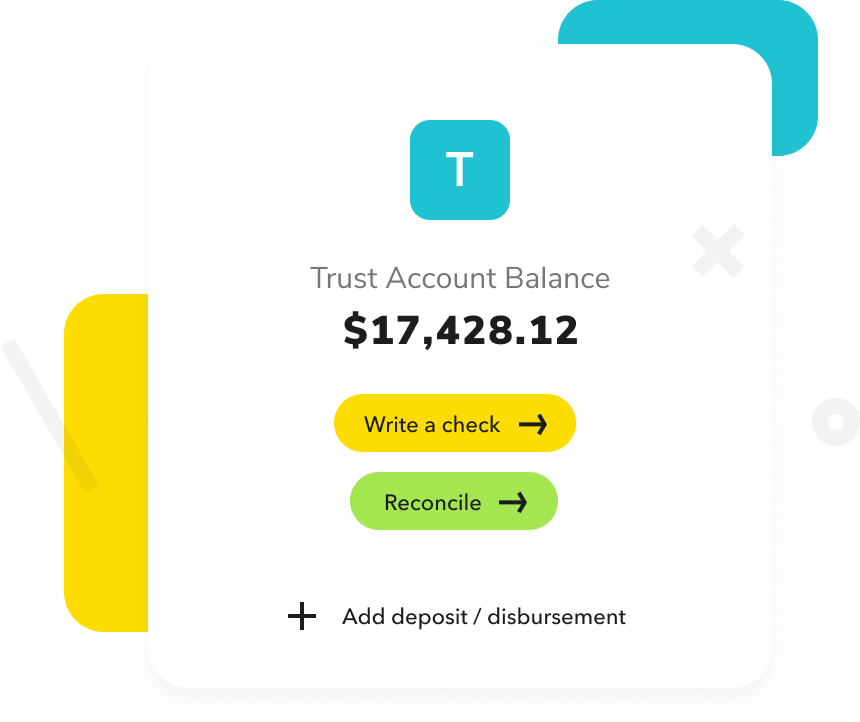

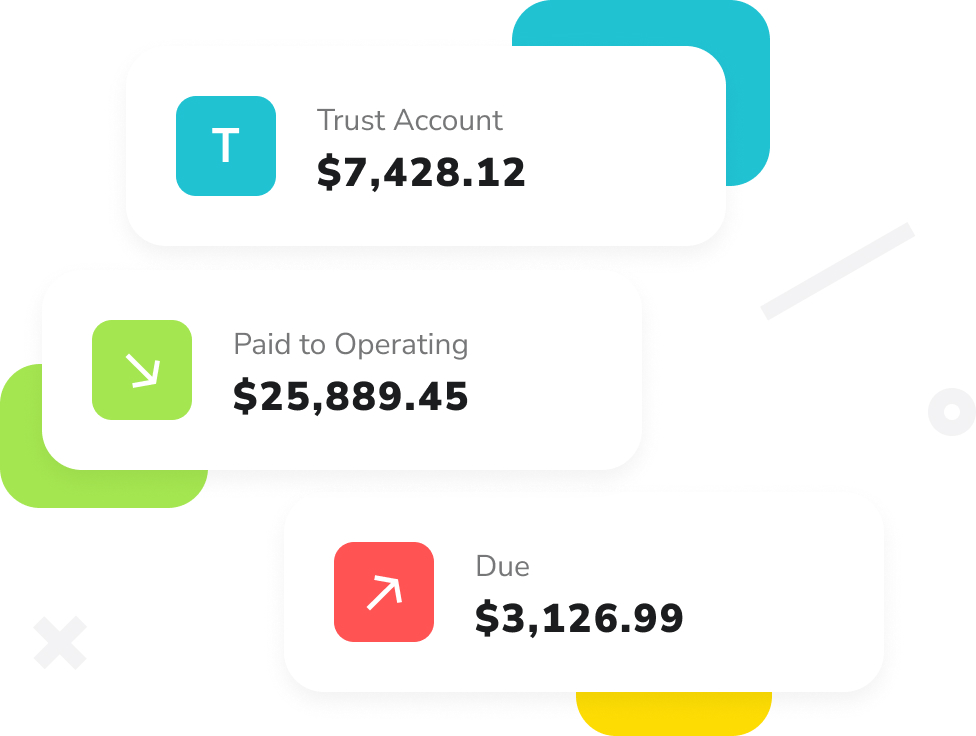

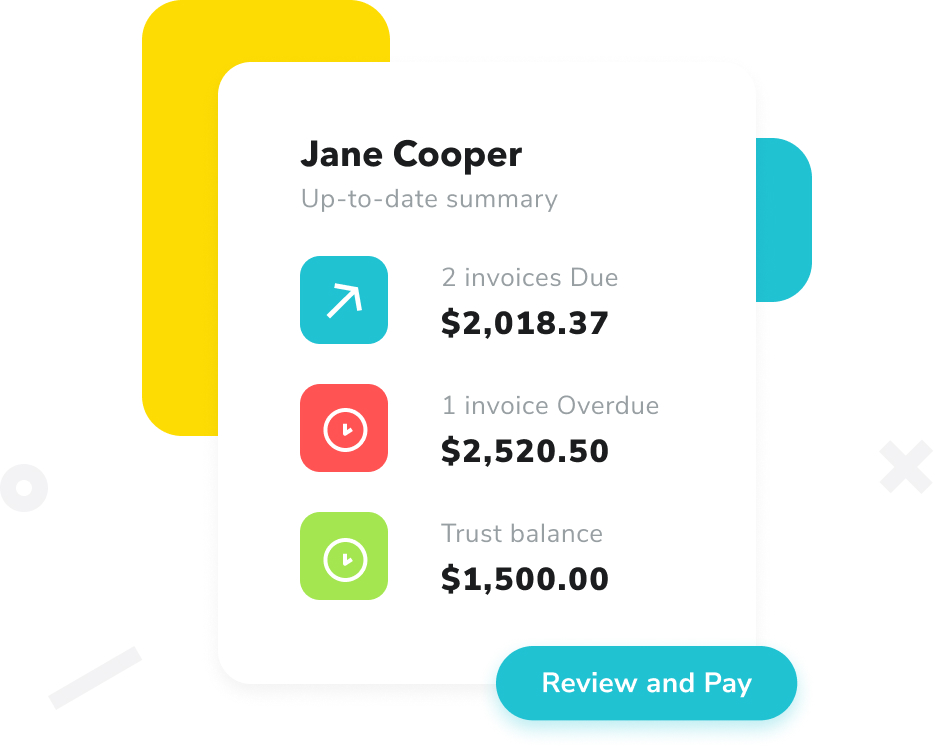

With our IOLTA compliant platform, you may direct client payments to either your operating account or IOLTA trust account. You can also integrate MONESQ with QuickBooks Online.

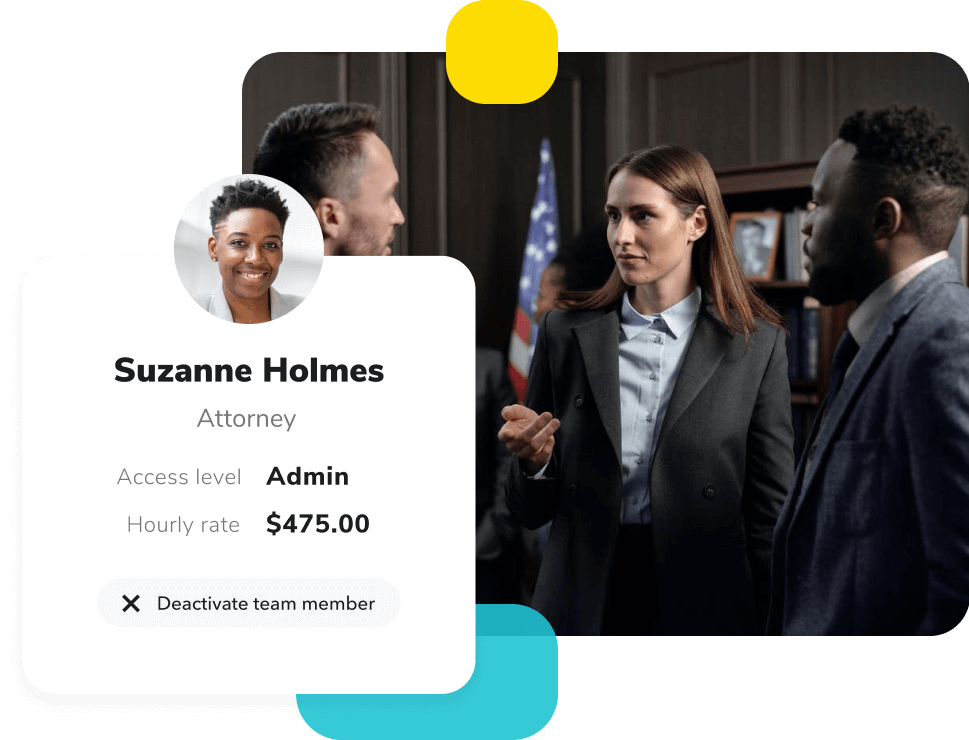

Add as many users from your firm as you want. It’s still free.